The word “budget” can stir up all kinds of emotions in people, not just nurses.

Confusion and anxiety are some of the feelings I’ve heard mentioned when talking about budgeting with others.

One observation I’ve made is that very few people know what a budget is, and the few who do don’t understand why they should create one in the first place.

You may have some of the same questions, such as “How do I make a budget?” or “Is a budget really that important?”

Well, look no further.

By the end of this article, you will not only understand what a budget is and why it is important to budget your money, but you will also learn how to create a budget successfully.

Additionally, I will debunk a couple of budgeting myths.

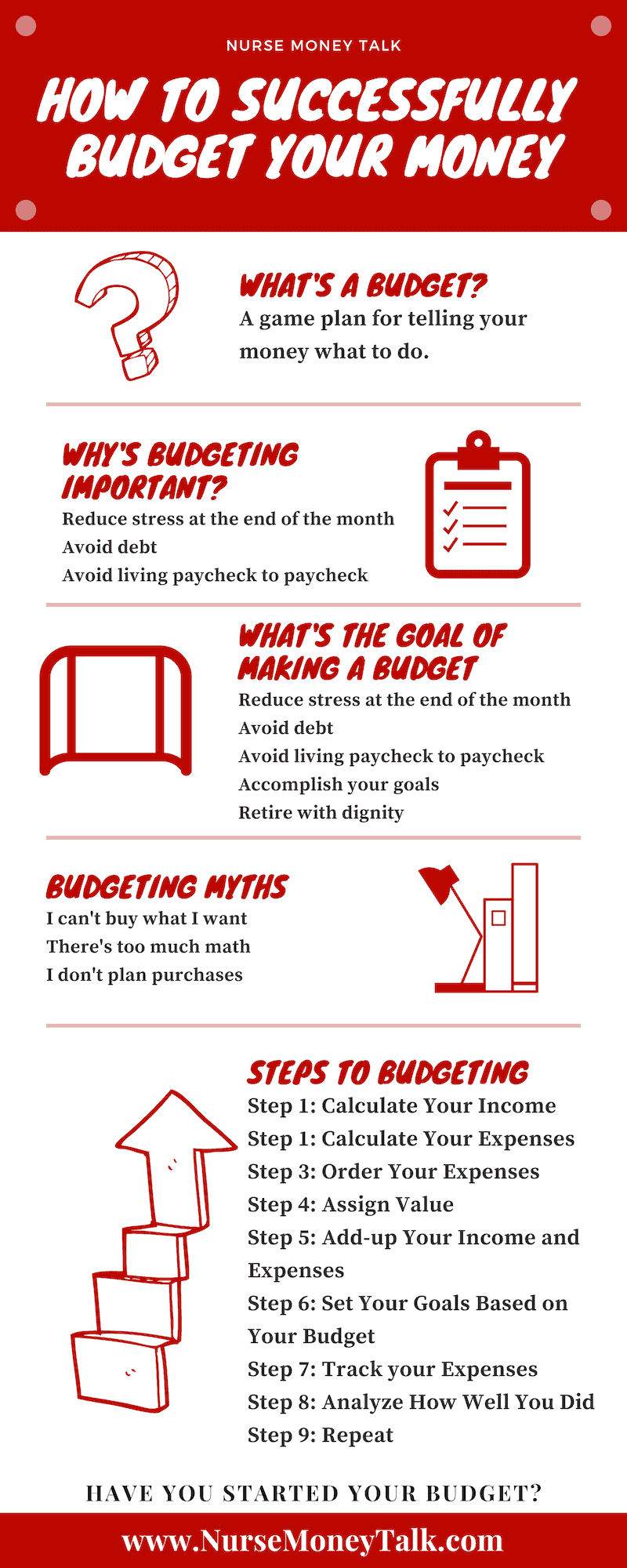

What Is a Budget?

To be super technical a budget is a projection or estimate of what your income and expenses are going to be for a specific period.

To put it in simple terms with a budget you’re getting a plan together of what your money is going to do.

The typical time frame for doing a budget is usually a month at a time.You can also do a budget that’s shorter or longer than a month.

With a budget, you’re planning for a couple of things:

- What are your sources of income?

- What’s your total income?

- What are your expenses?

- How does your income compare to your household costs?

- How can I Improve my budget to accomplish my goals?

Why is Budgeting Important

We just discussed how planning a budget can help you manage your finances. You might be wondering why having a budget is important.

The answer is simple: budgeting allows you to keep track of your income and expenses.

When you have a clear idea of your financial situation, you can ensure that you have enough money to cover your bills and purchase the things you need and want, without falling into debt.

Creating a budget may seem daunting, but it can actually reduce stress. When you have a detailed plan for the month, you know exactly where your money is going.

You don’t have to worry about running out of money at the end of the month because you’ve already spent it on non-essential items.

What is the Goal of Making a Budget

Learning how to successfully manage your money accomplishes so many goals.

1. Avoid living paycheck to paycheck

Not keeping tabs on your expenses can put you at risk for not being able to pay your bills.

Plus make it likely that you’ll run into a situation where you’re living paycheck to paycheck.

When you’re spending money without keeping tabs, you might not have enough in reserve for emergency situations. Living paycheck to paycheck increases the risk of going into debt.

2. Avoid Debt

Poor money management or in this case lack thereof can put you at risk for getting into debt.

When you don’t have enough money to pay for things, poor planning might make you resort to debt. Being cornered with debt as your only escape is never a good place to be.

3. Decrease stress

Did you know having a plan for your money lowers stress?

Wait, what?

Sitting down and running a budget will make it, so you’re not last minute trying to figure out how you’re going to pay the light bill.

Here’s a quick example of what a budget can do for you.

Let’s say you did your budget at the beginning of the month and realize you’re going to be short one hundred dollars by the end of the month.

You know what?

You now have 30 days to figure it out as opposed to finding out about it when it’s either due or worse overdue.

4. Vacations or _________

So many nurses will look at budgets as restricting what they can or cannot buy instead of looking at a budget as helping you achieve your goals and dreams.

It doesn’t have to be a vacation, but it could be a nice car or house.

5. Retire with dignity

You might think it’s far into the future and for many younger nurses, it probably is. Don’t get too complacent though because when retirement comes, it’s going to come in a blink of an eye.

You need to start preparing for your retirement. One of the best ways to prepare for retirement is by budgeting.

The indirect result of budgeting your money is you’ll be able to make your money more efficient and find places you can cut to be able to save for retirement.

Retirement planning for nurses is a must. Relying solely on social security is not a good way to retire with dignity.

Budgeting Myths Debunked

A budget is many things, but so many people have some misconceptions about budgeting.

Below are just a few misconceptions that need to be corrected when it comes to managing your money successfully.

1. I can’t buy what I want with a budget

One of the quotes I’ve heard is that we need to change the way we think about budgeting.

You might think of creating a budget as restricting, or not letting you buy what you want. Instead, think of a budget as giving you permission to spend.

Permission to spend?

Yes!

When you prepare a budget, you’re setting up ahead of time what you’re going to buy.

You might realize after doing a budget that you do have the money to buy that nice outfit or that new phone. A budget can reveal where you’re overspending and need to cut back on.

Which would free up money to go elsewhere. Don’t let your money tell you what to do, instead show your money where it needs to go.

2. I hate math

I’ve had one nurse tell me they don’t like budgeting because they hate doing math.

Many people don’t like doing math, but the good thing about this is nowadays you don’t have to love math.

There are so many online programs out there such as Mint or YNAB that make this easy.

With many of those resources, all you have to do is plug in the numbers, and the software does all the work for you.

3. I don’t plan purchases

A budget probably will limit your impulse purchases.

Keep in mind if your impulse purchases are putting you at risk for

- not paying your bills,

- living paycheck to paycheck,

- or going in debt

than your impulse purchases should be checked.

How to Successfully Budget your Money-Creating your Budget

Now that you understand what a budget is and why it’s so important. We’re going to help you get on your way to creating a budget.

Intro

As nurses working in today’s healthcare climate, we have to be versatile and ready for whatever challenge is presented to us.

Whether it was going through nursing school, studying for the NCLEX, or working on the floor nurses, have to learn to prioritize.

Nurses learn to prioritize and plan because they’re limited in what they can do.

Let’s face it we learned to budget our time because we didn’t have the luxury to accomplish everything we need to on most days.

We understood the concept there’s only so much time to go around.

In that same sense, you need to apply the mindset of planning and prioritization to budgeting your money because just like time there’s only so much money to go around.

Are the Wealthy Excused from Making a Budget?

Some people might have more money than others, but at the end of the day, there’s a limited amount.

Wealthy people are not excused from this; I’m sure we all have seen those tv specials of wealthy people who went broke.

A Lot of that stems from a lack of budgeting and knowing where exactly your money is going.

Because of that, you have to learn how to successfully budget your money by prioritization.

There are many ways to do this, but I’m going to lay out a straightforward way to get started, based on a one-month interval:

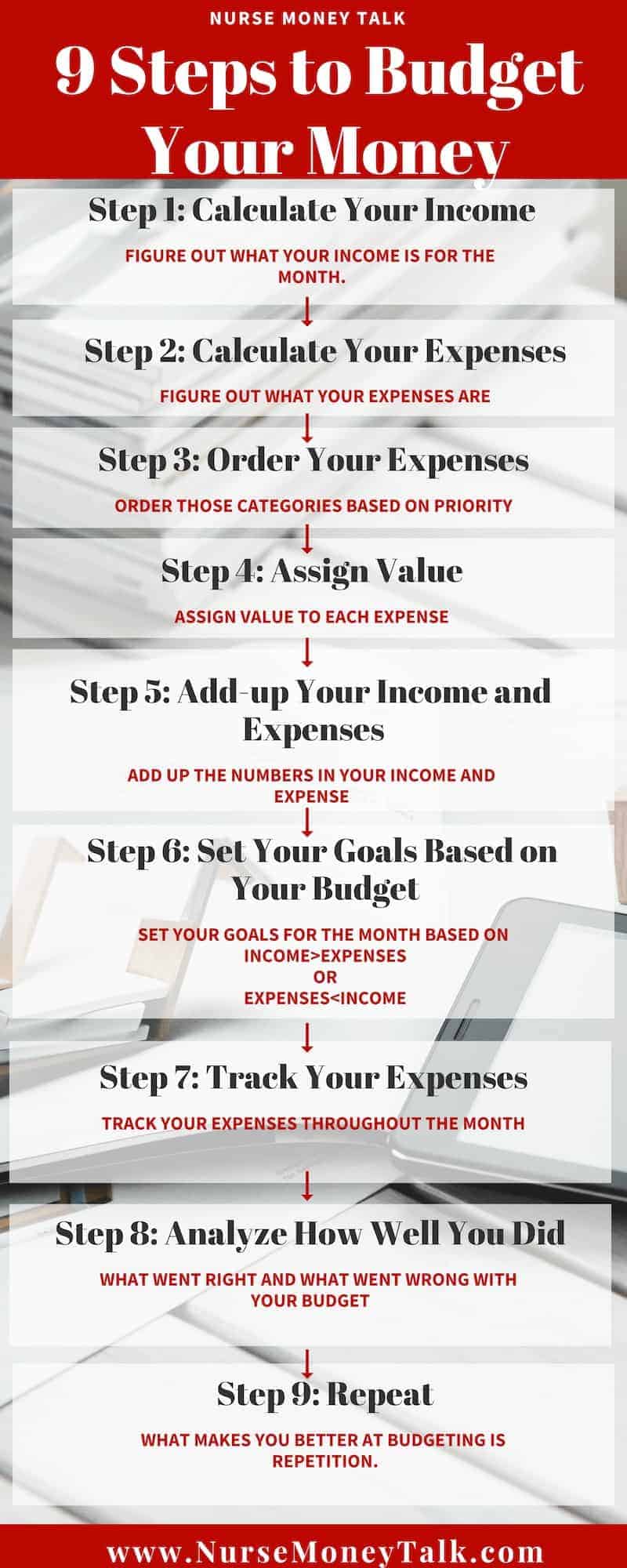

Step 1. Calculate Your Income

Figure out what your income is for the month. You need to count all forms of income that you receive.

So, for example, a paycheck from work, child support, etc.

Keep in mind this also includes investments, businesses and side hustles that you have.

Step 2. Calculate Your Expenses

You need to figure out what your expenses are. List out all your expenses and put them into major categories.

You could break them down into detailed categories but to begin with, break them up into major categories until you get more used to doing a budget.

For example, food, car payments, utilities, cable, etc.

“…we need to apply the mindset of planning and prioritization to money…”

— Thomas N. Uzuegbunem, BSN, RN

To gather your expenses, check out bank statements, receipts.

Make sure to add household costs that could be unexpected for example car-related costs (repair, oil change) and so forth.

Step 3. Order your Expenses

Order those categories based on priority. The starting point in your budget should be food, water(utilities) and shelter(rent/mortgage).

Step 4. Assign Value

Once you have those listed out in order, assign values to each expense.

Some of those are fixed (doesn’t really change every month) such as rent/mortgage. Others are variable (can vary from month to month) such as utilities.

However, you want to assign each category an amount of money that you believe will be your expected bill.

The easiest way to do this would be to look back and see what your previous month’s expenses were.

So, on average how much are you spending a month on food? How much is your mortgage or rent?

How much was your car payment the previous month? How much do you estimate you spent on gas or transportation last month?

After the essential expenses, you can start working your way down. After the necessities would be non-necessity items such as cable.

If you’re new to budgeting, this may be difficult. You’re not going to get this right the first time around. Don’t lose heart!

Step 5. Add-up Your Income and Expenses

Add up the numbers in your income category. Then add up the numbers on your expense category.

Don’t be surprised if you start feeling some anxiety depending on how the numbers look.

Step 6. Set Your Goals Based on Your Budget

This next step is all about setting your goals based on how your budget initially looks.

If your expenses are greater than your income one of your goals might be trying to lower your costs or trying to increase your income.

Income > Expenses

Step 6a.

If your income is greater than your total expenses, you’re moving in the right direction.

Step 6b.

Analyze your expenses. Do you have a category in there for savings? What about retirement?

Do you have any other short or long-term goals?

Based on those things you might have to revisit your expense category to see if you can lower any of your expenses to make some of those goals possible.

Income < Expenses

Step 6a.

If your expenses are greater than your total income, you need to go back through your expenses.

Going back through your expense column is going to be one of the most difficult parts of making a budget. Getting rid of things that you don’t need that are costing you.

If step 3 was organized correctly, start from the bottom of your expense column and work your way up. What can you live without? Is it cable?

Are you eating out a lot? Do you have a gym membership you’re paying for but haven’t used in months? We all have expenses that we could cut to free up our monthly cash flow.

Sacrifices can be painful for the moment, but ultimately knowing you’ll not run out of money at the end of the month is worth it!

When you do your budget if your expenses are consistently greater than your income you’re at risk for charging the extra on credit cards.

While this might not seem like such a big deal, in the long run, it’s untenable.

Step 6b.

If your expenses are more than your income, you could look at your income category to see how you can increase your monthly income.

Short term this might be more difficult to accomplish but long-term that might be the best plan.

Short term the best bet is to manage your household expenses, but overall the long-term focus and push should be to build your income.

Step 7. Track Your Expenses

Track your expenses throughout the month. Try not to go over your allotted amount for each category.

If you go over your allotted amount is it because you misjudged it or is it something else? If you go over your budget in a designated category, what other group are you going to pull the money from?

Tracking your expenses gives you an opportunity at the end of the month to assess where all your money went.

After watching your household expenses for a month, you’ll be surprised at all the little things we tend to spend money on that adds up real quick by the end of the month.

Budgeting Your Money Example:

Not to pick on coffee drinkers but it’s something I’ve personally experienced myself. Spending $5 a day on coffee doesn’t sound like it’s a big deal until I started adding it up.

If I’m spending $5 a day on coffee than in a month, I’ll pay $150.

There’s nothing wrong with spending $150 on coffee if you can afford it but I would bet some of you would rather trim that down to half and use that money elsewhere.

It doesn’t have to be coffee. You can replace it with drinking, eating out, cable and the list goes on and on.

Step 8. Analyze How Well You Did

Analyze what went right and what went wrong. Look at ways to improve your budgeting and your spending.

Step 9. Repeat

Repeat. What makes you better at budgeting is repetition. This guide was made to be simple to get you going.

It may be simple, but it does require work, especially in the beginning phase. It’ll probably take a couple of months to start getting the hang of it.

Final Thoughts on Budgeting

Learning how to budget your money successfully is simple in the sense that it’s not complicated, but it’s hard work and requires discipline.

Remember, budgeting is a great tool to help you accomplish your goals.

So, make sure that you’re setting SMART goals when you start budgeting. Some goals to think about would involve:

- Saving for Vacations

- Saving for Emergencies

- Saving for Retirement

- Buying a New Car

- Buying a Home

What are your goals, and what works to help you successfully budget your money?

Please take a quick second to hit one of the share buttons so we can spread the word and educate others.

This was such a great read! All the nurses I know are super practical people (in addition to being very caring, of course), so financial advice from a nurse is definitely something I can get on board with. 🙂 Thank you for sharing!

I appreciate it. It’s definitely one of my passions.

Thank you for the kind words. Glad you liked the article.

Great post. Do you recommend any software or do you use excel?

Thank you. I have used excel in the past. I prefer software such as mint.com. Software like mint allows alot of things such as entry of purchases to be automated. If it’s not automated I have more excuses to not do a budget.

Excel especially is someone is just getting started can be am excellent tool to begin with.

Hey Derek, my favorite budgeting software is this one.

This is a great walkthrough of how to create a budget. So many people fail to plan and don’t take the time to sit down and see how much money they have coming in and how much money they have going out. It is such a shame. As you pointed out it isn’t that challenging it just takes time and a little work.

Exactly! Thank you for reading the article and commenting.

These are great tips for anyone, not just nurses! 🙂 Thanks for sharing.

I’m glad you liked it.

I stumbled on this post not realizing it was written by a nurse. You make some great points and you are right this information is applicable to many. I think once I realized early in that I was not depriving myself by budgeting I felt a whole lot better and was much more accepting.

Absolutely. It’s a mind shift. You go from a budget depriving me of what I want. To a budget helping me achieve my goals.

This is amazing information! I’ve been trying to start a budget but get overwhelmed with all the things I have to think of. This is just what I’ve been looking for.

I’m glad you found this post helpful.