So you got your first paycheck.

You look at your nurse pay stub and are now wondering what all of these numbers mean!

“How did I make $1000 and yet only got $800 of that money??”

Between Uncle Sam (IRS), health insurance, and potentially any employee purchases you may have made, your take-home pay seems less than exciting.

Let’s talk about all the different hands that are reaching into your money jar.

*Disclosure: This post may contain affiliate links. If you click and make a purchase, I may receive a commission. For more info, please see my disclaimer.

Why Should You Pay Attention to Your Nurse Pay Stub?

Even though it’s tedious and annoying, checking your paystub every pay period is important.

Before direct deposit, it was a lot easier to review this information because every pay period you were handed a physical check with the information.

Now because it’s directly deposited into your bank and the information is probably on a website, and like most things, it’s not as convenient to log in and check.

Too often, we assume that it’s correct. If nobody has told you yet, let me be the first to say to you Don’t assume your paycheck is right.

It’s your money!

I made that mistake once.

I was online at the company site for some other reason, and I just happened to be curious about what the layout of the pay stub was.

When I clicked on it, I was surprised to see that my paycheck was wrong.

Upon further review, not only was it wrong, but it had been wrong for the past several pay periods.

It was a hassle to go back and fix it from several paychecks ago.

I eventually did get it fixed but the moral of the story was that if I was checking it regularly, I would have caught that mistake much sooner and it would have made life a lot easier.

Checking your nurse pay stub is not just about making sure you’re getting paid, but it’s also about making sure your taxes are being taken out appropriately.

If too much tax is taken out, then you will get a big refund and if too little is taken out, you will potentially owe taxes.

Don’t be that person who finds out during tax season that taxes being taken out of your paycheck was so small that you now owe a huge “lump” sum in taxes.

It’s not a good feeling, trust me.

Suddenly owing a $1000+ in taxes that was not planned is no bueno!

Related Article: Can a Nurse Become a Millionaire?

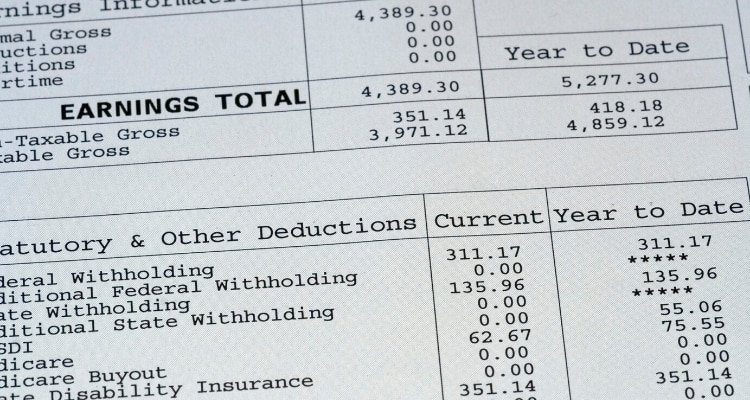

The Parts of Your Pay Stub

1. Period Start/End

This is important because it determines how the other numbers are calculated.

Typically, if you are a salaried worker, this range will be over a month.

If you’re an hourly employee, then this date will be over a week or 2 weeks, depending on your company’s pay period.

2. Gross Wages/Current Earning

This is the total amount of money you were paid for the given pay period (before any withholdings or deductions).

If you’re on salary, then it would be your salary per year divided by the number of pay periods you have in a given year.

If you’re an hourly worker, then it would be the number of hours you worked in that given pay period times your hourly pay rate.

3. Federal Taxes

This is the amount of money that was taken out for federal income taxes.

The amount will vary depending on the exemptions that were taken when you filled out the W-4 tax form.

4. FICA (Medicare)

It’s a combination of social security and Medicare taxes paid by both employee and employer.

Medicare is a federal government program that employees have to pay (your employer matches it) into the system (source).

Some of the benefits the program provides are hospital payments for Americans age 65 and older and disability benefits.

5. State Tax

The amount of your money that went to the state. Not applicable for all states because some states do not have an income tax (ex. Texas).

6. City Tax (if applicable)

The amount of money taken out going to your city. Not everyone will have this just depends on your city.

7. Social Security

Payment into the social security system.

The employee puts in 6.2% of their gross income into the system, and the employer matches it and also pays into the system (source).

Social security provides benefits to current recipients such as retired workers who also paid into the system (source).

8. Medical Reimbursement/Pre-tax Benefits

The amount of money taken out for medical-related pre-tax benefits.

Such as HSA or flex spending plans. HSA and flex are accounts that you contribute your pre-taxed money (i.e., money that has not been taxed) for healthcare-related expenses.

Both of them have their pros and cons.

9. Insurance Deductions

Taken out for insurance premiums.

This would be the amount you are required to pay for the insurance plan you have through your employer.

Usually calculated per month but the amount is typically split up between the number of pay periods you have in a month.

Example: if you get paid twice a month, your premium would be divided by two and that amount will come out each pay period.

Some employees are fortunate enough to have their employer pay some or all of their premiums.

10. YTD Pay

This is the total amount you have been paid since the beginning of the current calendar year. When you multiply your gross pay by the number of pay periods you have so far in that calendar year.

So if the current pay period is in October. The YTD pay would be how much you have been paid since January of that current year.

11. YTD Deductions

This is the amount of money that has been deducted from your paycheck that calendar year.

12. Net Pay

The amount of money that you received during the pay period. This is after taxes and deductions.

Typically this will be less than your gross pay. If you’re a new nurse, the sky’s the limit for you from this point forward.

Final Thoughts

Note:

Paystubs will vary from company to company based on design and wording. from all companies look different. Use this as a guide to start figuring things out.

Have you looked at your paystub before and discovered that it was very wrong!?